Biomarker Discovery Outsourcing Services Market Expands from US$16.9Bn to US$43.7Bn – Persistence Market Resaerch

Biomarker discovery outsourcing services market grows with precision medicine, multi-omics research, and rising global clinical trial activity.

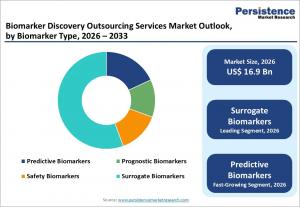

LONDON, UNITED KINGDOM, February 16, 2026 /EINPresswire.com/ -- The global biomarker discovery outsourcing services market is poised for significant expansion over the next seven years, fueled by rising biopharmaceutical research spending and the growing shift toward precision medicine. According to industry estimates, the market is projected to increase from US$ 16.9 billion in 2026 to US$ 43.7 billion by 2033, registering a compound annual growth rate (CAGR) of 14.5% during the forecast period. This follows a healthy historical CAGR of 13.0% recorded between 2020 and 2025, reflecting sustained demand for specialized research partnerships.

Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/35423

Biomarker discovery outsourcing services play a crucial role in modern drug development by enabling pharmaceutical and biotechnology companies to identify, validate, and implement biological indicators that guide diagnosis, prognosis, and treatment decisions. As therapeutic pipelines become increasingly complex, sponsors are relying on contract research organizations (CROs) and specialized laboratories to manage high-throughput sequencing, multi-omics data integration, and regulatory-grade validation processes.

Market Dynamics Driving Growth

A key growth driver is the rapid rise of personalized medicine. Tailored therapies require integration of genomic, proteomic, and metabolomic data to identify distinct patient subgroups. Few companies maintain the advanced computational infrastructure and AI-enabled analytics needed for such multidimensional research in-house. Outsourcing partners provide high-end bioinformatics platforms, scalable lab operations, and compliance-ready documentation, accelerating biomarker-based drug programs.

Strategic collaborations are further shaping the competitive landscape. For instance, AstraZeneca partnered with ANGLE to advance liquid biopsy assay development, while also collaborating with Roche to co-develop digital pathology algorithms for biomarker identification. Such alliances underscore the increasing interdependence between pharmaceutical sponsors and specialized diagnostic innovators.

However, regulatory complexities remain a major restraint. Agencies such as the U.S. Food and Drug Administration and the European Medicines Agency now demand biomarker assays meet stringent analytical validation standards similar to commercial diagnostics. Compliance with frameworks like the European Union’s In Vitro Diagnostic Regulation (IVDR) has compelled outsourcing firms to upgrade laboratory certifications and quality systems, increasing operational costs and extending assay development timelines.

Emerging Opportunities in Multi-Omics and Spatial Biology

The evolution from single-analyte biomarkers to multi-omic and spatial biomarkers presents significant opportunities. Spatial transcriptomics and proteomics require advanced imaging systems and AI-powered data pipelines, prompting sponsors to seek niche expertise externally. Companies such as Veranome Biosystems and Genospace are capitalizing on this trend by offering spatial multi-omics as a service.

Large-scale proteomics initiatives also illustrate market momentum. Thermo Fisher Scientific’s Olink Explore platform was selected for the U.K. Biobank Pharma Proteomics Project, analyzing thousands of proteins across hundreds of thousands of samples to improve disease prediction models. Such projects highlight the growing reliance on outsourced platforms capable of handling real-world data integration and longitudinal biospecimen analysis.

Get Custom Insights Designed for Your Business: https://www.persistencemarketresearch.com/request-customization/35423

Segment Analysis

By biomarker type, surrogate biomarkers dominate the market and are expected to hold over 55% share in 2025. Their ability to accelerate regulatory approvals and serve as proxy clinical endpoints makes them particularly valuable in oncology and chronic disease research. Regulatory recognition of surrogate endpoints under accelerated approval pathways has further strengthened their adoption.

Predictive biomarkers are anticipated to record the fastest growth through 2033. These biomarkers inform treatment decisions and stratify patient populations, improving therapeutic efficacy while reducing trial attrition rates. Increasing use of predictive markers in oncology trials underscores their expanding role in outsourced study designs.

In terms of therapeutic area, oncology leads the market with an estimated 34.6% share in 2025. Cancer drug development depends heavily on molecular profiling, immune signatures, and gene mutation analysis, driving extensive outsourcing demand. Autoimmune diseases and neurology segments are also witnessing steady growth due to the need for multiplex biomarker panels and transcriptomic analysis.

Regional Outlook

North America remains the dominant regional market, accounting for 44.7% share in 2025. The United States hosts the largest number of registered clinical trials globally and benefits from robust funding by institutions such as the National Institutes of Health. Strong CRO presence and well-established regulatory frameworks reinforce the region’s leadership.

Europe holds a substantial share supported by high R&D expenditure and collaborative research infrastructure across Germany, the United Kingdom, and France. Harmonized regulatory systems under the European Medicines Agency further promote outsourcing activity.

Asia-Pacific is the fastest-growing region, driven by expanding clinical research capacity in China, India, Japan, South Korea, Australia, and Singapore. Government incentives, cost-efficient services, and increasing biotechnology investments are accelerating regional demand for outsourced biomarker discovery solutions.

Competitive Landscape

The competitive environment is characterized by technology-driven differentiation, strategic acquisitions, and expanded service portfolios. Leading players include Laboratory Corporation of America Holdings, Celerion, Charles River Laboratories, Eurofins Scientific, GHO Capital, ICON plc, Evotec, Parexel International, Thermo Fisher Scientific Inc., and Proteome Sciences.

Checkout Now & Download Complete Market Report: https://www.persistencemarketresearch.com/checkout/35423

Global Biomarker Discovery Outsourcing Services Market Segmentation

By Biomarker Type

Predictive Biomarkers

Prognostic Biomarkers

Safety Biomarkers

Surrogate Biomarkers

By Therapeutic Area

Oncology

Cardiology

Neurology

Autoimmune Diseases

Others

By Discovery Phase

Biomarker Identification

Biomarker Validation

Biomarker Profiling

Biomarker Panel Development

Biomarker Selection

By End User

Pharmaceutical Companies

Biotechnology Companies

Others

By Region

North America

Europe

East Asia

South Asia & Oceania

Latin America

Middle East and Africa

In September 2025, GHO Capital acquired Scientist.com to enhance AI-powered R&D orchestration capabilities, while Thermo Fisher Scientific showcased expanded biopharma solutions at CPHI Milan 2024. As pharmaceutical pipelines grow more specialized, outsourcing partnerships are expected to remain central to biomarker-driven innovation through 2033.

Read Related Reports:

Africa Pharmaceuticals Market: Africa’s pharmaceuticals market set to reach US$44.1 billion by 2032, up from US$29.3 billion in 2025, driven by NCDs and policy reforms at a 6.1% CAGR.

Neurology Contract Research Organization Market: The neurology contract research organization market grows from US$ 9.8 billion in 2026 to US$ 15.5 billion by 2033, driven by a strong 6.7% CAGR

Persistence Market Research

Persistence Market Research Pvt Ltd

+1 646-878-6329

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.