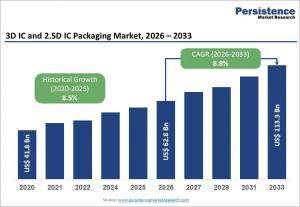

3D IC and 2.5D IC Packaging Market US$113.3 Billion Growth Outlook Driven by AI and High Performance Computing Demand

Asia Pacific Leads with 42.6% Share in 2026 Backed by Strong Foundry OSAT and Electronics Manufacturing Ecosystem

LONDON, LONDON, UNITED KINGDOM, February 9, 2026 /EINPresswire.com/ -- The 3D IC and 2.5D IC packaging market is emerging as a cornerstone of next generation semiconductor innovation, enabling higher performance, reduced power consumption, and compact chip architectures. Unlike traditional planar packaging, these advanced approaches allow vertical stacking or close interconnection of dies, significantly improving bandwidth and signal integrity. As semiconductor scaling faces physical and economic limits, advanced packaging has become a critical pathway to sustain Moore’s Law performance gains.

Discover Exclusive Data – Request Your Free Sample : https://www.persistencemarketresearch.com/samples/36000

The global 3D IC and 2.5D IC packaging market size is likely to be valued at US$62.8 billion in 2026 and is expected to reach US$113.3 billion by 2033, growing at a CAGR of 8.8 percent between 2026 and 2033. This strong growth is driven by rising requirements for high bandwidth, energy efficient semiconductor architectures supporting artificial intelligence, machine learning, and high performance computing workloads across industries.

Why Advanced IC Packaging Is Gaining Strategic Importance

Advanced IC packaging is no longer a back end manufacturing step but a strategic differentiator in chip performance. 3D IC and 2.5D IC packaging technologies enable shorter interconnect paths between dies, which reduces latency and power loss while boosting processing speed. These benefits are essential for data intensive applications such as AI inference, cloud computing, and real time analytics. As system on chip complexity increases, heterogeneous integration through advanced packaging allows logic, memory, and specialized accelerators to be combined within a single package. This flexibility supports faster product innovation cycles and improved system level performance without relying solely on smaller transistor nodes.

Role of AI and High Performance Computing in Market Growth

Artificial intelligence and high performance computing are among the most influential growth drivers for the 3D IC and 2.5D IC packaging market. AI workloads require massive parallel processing and high memory bandwidth, which traditional packaging solutions struggle to support efficiently. Advanced packaging enables closer integration of processors and memory, addressing these performance bottlenecks. In data centers and supercomputing environments, energy efficiency is equally critical. 3D and 2.5D IC architectures reduce power consumption per operation, helping operators manage energy costs and thermal challenges. As AI adoption expands across industries, demand for advanced packaging solutions is expected to rise steadily.

Make This Report Fit Your Needs – Customize Now :

https://www.persistencemarketresearch.com/request-customization/36000

Technology Advancements Transforming Packaging Capabilities

Continuous innovation in packaging technologies is reshaping the competitive landscape. Through silicon vias, wafer level chip scale packaging, and hybrid bonding variants are enabling higher density interconnections and improved yield rates. Hybrid bonding in particular is gaining traction due to its ability to deliver fine pitch interconnects with lower resistance and improved reliability. Manufacturers are also investing in advanced materials and process automation to enhance scalability and cost efficiency. These developments are making 3D IC and 2.5D IC packaging more accessible for a broader range of applications beyond high end computing.

Market Segmentation

By Packaging Technology

3D IC Packaging

2.5D IC Packaging

3D TSV

3D WLCSP

Hybrid Bonding Variants

By Application

High Performance Computing (HPC)

Consumer Electronics

Logic (CPUs/GPUs)

Memory

Imaging & Optoelectronics

LED/Power devices

By End use Industry

Consumer Electronics

High performance Computing & Data Centers

Automotive (ADAS/EV)

Telecommunications (5G)

Industrial/Medical

Military & Aerospace

By Region

North America

Europe

East Asia

South Asia & Oceania

Latin America

Middle East & Africa

Application Expansion Across Key Industries

While high performance computing remains the dominant application, advanced IC packaging is expanding rapidly into consumer electronics, automotive, and telecommunications. Smartphones, gaming devices, and wearables increasingly rely on compact and power efficient chip designs enabled by 2.5D packaging solutions.

In the automotive sector, advanced driver assistance systems and electric vehicles demand reliable, high performance semiconductors capable of operating under harsh conditions. Advanced IC packaging supports these requirements by improving thermal management and system integration. Similarly, the rollout of 5G infrastructure is driving demand for high frequency and low latency semiconductor solutions.

Regional Trends Shaping the Market Landscape

East Asia leads the global 3D IC and 2.5D IC packaging market due to its strong semiconductor manufacturing ecosystem and presence of leading foundries and OSAT providers. Countries such as Taiwan, South Korea, and Japan are at the forefront of advanced packaging innovation and capacity expansion.

North America remains a key market driven by strong demand from data centers, defense applications, and AI technology developers. Europe is witnessing steady growth supported by automotive electronics and industrial automation. Emerging regions such as South Asia and Latin America are gradually increasing adoption as semiconductor investments expand.

Exclusive Data Awaits – Continue to Checkout: https://www.persistencemarketresearch.com/checkout/36000

Company Insights and Competitive Landscape

The market is highly competitive, with leading players investing heavily in research and development, capacity expansion, and strategic partnerships to strengthen their advanced packaging capabilities.

✦ TSMC

✦ Samsung Electronics

✦ Intel

✦ ASE Technology

✦ Amkor Technology

✦ JCET Group

✦ Siliconware Precision Industries (SPIL)

✦ Powertech Technology Inc. (PTI)

✦ Micron Technology

✦ Texas Instruments

✦ Broadcom

✦ UMC

✦ Samsung Electro Mechanics

✦ Ibiden

✦ Unimicron

These companies are focusing on next generation packaging platforms to support heterogeneous integration and meet growing customer requirements across AI, HPC, and automotive markets.

Future Outlook of the 3D IC and 2.5D IC Packaging Market

The future of the 3D IC and 2.5D IC packaging market looks highly promising as semiconductor innovation increasingly shifts toward advanced integration rather than pure scaling. Continued investment in AI, cloud computing, and connected technologies will sustain long term demand for high bandwidth and energy efficient packaging solutions.

As manufacturing processes mature and costs decline, advanced IC packaging is expected to penetrate a wider range of applications, reinforcing its role as a critical enabler of next generation electronics. Companies that can deliver scalable, reliable, and performance optimized packaging solutions will be best positioned to lead the market through 2033.

Explore the Latest Research Paper :

Magnetic Closure Boxes Market

Thin Wall Packaging Market

Persistence Market Research

Persistence Market Research Pvt Ltd

+1 646-878-6329

email us here

Visit us on social media:

LinkedIn

Instagram

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.