Europe Vegan Protein Bars Market to Hit USD 980.8 Million by 2035 Led by Spain, Netherlands, and Italy

Demand for vegan protein bars in the EU is driven by growing health consciousness, environmental concerns, and a shift toward plant-based, clean-label snacking

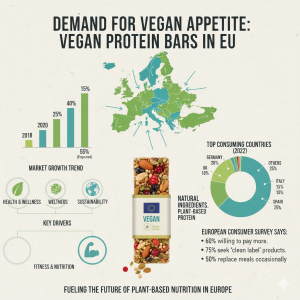

NEWARK, DE, UNITED STATES, October 14, 2025 /EINPresswire.com/ -- The Europe vegan protein bars market is entering a transformative growth phase, forecast to expand from USD 189.0 million in 2025 to USD 980.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 17.9%. This exceptional trajectory underscores the rapid evolution of Europe’s plant-based nutrition sector, as consumers increasingly prioritize health, sustainability, and convenience in everyday dietary choices.

EU Market Forecast: From Emerging Trend to Core Nutrition Segment

Between 2025 and 2035, demand for vegan protein bars in the European Union is projected to grow by 417.1%, translating to an absolute increase of USD 788.4 million. The industry is set to multiply by 5.2 times over the decade, driven by rising adoption of flexitarian and vegan diets, expanding sports nutrition participation, and strong consumer interest in clean-label, functional foods.

During the first half of the forecast period (2025–2030), the market will grow from USD 189 million to USD 422.4 million, marking a 29.6% contribution to the decade’s overall expansion. The latter half (2030–2035) will see a steeper growth curve—an additional USD 555 million, accounting for 70.4% of total growth, propelled by online retail development, ingredient innovation, and growing demand for certified organic and ethically sourced plant proteins.

Regional Insights: Spain and the Netherlands Lead EU Growth Momentum

Spain is set to record the fastest growth in Europe with a 20.0% CAGR through 2035, supported by expanding fitness culture, modernized retail channels, and exposure to international wellness trends through its tourism industry. Major supermarket chains such as Mercadona, Carrefour España, and Lidl España are driving market normalization by dedicating greater shelf space to vegan and sports nutrition products.

The Netherlands follows closely with a 19.0% CAGR, reflecting the country’s leadership in sustainable food innovation and organic retail infrastructure. Dutch consumers, among Europe’s most environmentally conscious, are embracing vegan protein bars as both a nutritional and ethical choice.

Italy (18.5% CAGR) continues its upward trajectory as health awareness and sports participation surge. Retail leaders such as Coop Italia and Esselunga are expanding product portfolios to cater to consumers seeking convenient, plant-based protein solutions that align with Mediterranean dietary principles.

Meanwhile, Germany maintains the largest market share at 22%, supported by its mature vegan infrastructure, widespread retail availability, and extensive fitness participation. France follows with a 17.0% CAGR, benefitting from evolving dietary patterns, boutique gym expansion, and rising demand for premium-quality protein bars across urban centers.

Market Composition: Fitness, Organic, and Soy-Based Bars Dominate

The fitness and sports nutrition segment is expected to account for 40% of total vegan protein bar demand by 2025, underscoring its dominance in performance-oriented consumption. Consumers increasingly view vegan protein bars as complete performance nutrition tools, optimized for muscle recovery, energy, and endurance rather than simple snacks.

By product type, soy-based bars hold a commanding 30% share of EU sales, supported by a robust supply chain, high protein quality, and strong consumer familiarity. Soy’s complete amino acid profile and digestibility make it the preferred choice among athletes and health enthusiasts seeking plant-based protein alternatives comparable to whey or casein.

The organic segment is positioned to contribute 59.4% of total sales by 2025, reflecting Europe’s deeply rooted sustainability and ethical sourcing values. Certified organic bars have become synonymous with trust and quality, appealing to consumers willing to pay premiums for clean-label, non-GMO, and environmentally responsible products.

In distribution, supermarkets and hypermarkets retain dominance with 45% market share, highlighting the role of mainstream retail access in driving consumer adoption. Major chains including Tesco, Carrefour, Edeka, and Albert Heijn are expanding shelf space for vegan protein bars within sports nutrition and health snack categories to increase visibility and trial.

Key Growth Drivers and Emerging Trends

1. Shift Toward Clean-Label and Functional Nutrition:

Manufacturers are reformulating products with natural sweeteners, minimal ingredient lists, and added functional benefits such as probiotics, adaptogens, and superfoods. This clean-label evolution transforms vegan protein bars from “processed snacks” into holistic nutrition solutions aligned with wellness lifestyles.

2. Sustainable Packaging and Ethical Messaging:

European producers increasingly employ compostable wrappers and recyclable materials, integrating sustainability into both product and packaging design. Brands are leveraging carbon footprint labeling and transparent sourcing claims to strengthen environmental credibility and attract eco-conscious consumers.

3. Personalized and Specialized Nutrition:

Vegan protein bar manufacturers are developing tailored formulations targeting distinct dietary needs—low-sugar, keto-friendly, allergen-free, and fortified options for specific fitness or wellness goals. This trend toward personalized nutrition supports premium pricing strategies and long-term consumer loyalty.

Competitive Landscape: Innovation and Brand Differentiation Define Market Leadership

Europe’s vegan protein bar market remains highly fragmented, with leading players including Clif Bar & Company (14%), RXBAR (Kellogg’s, 12%), No Cow (10%), and Orgain (8%), alongside a dynamic ecosystem of regional brands and private labels controlling the remaining 56%.

• Clif Bar & Company leverages its organic portfolio and widespread distribution to strengthen brand trust across mainstream and specialty channels.

• RXBAR emphasizes ingredient transparency and minimalism, appealing to label-conscious consumers seeking authenticity.

• No Cow utilizes a digital-first, influencer-driven strategy to engage fitness and wellness communities.

• Orgain positions itself as a clinical nutrition brand, focusing on functional health benefits and professional endorsements.

Fragmentation across markets presents significant opportunities for new entrants and innovative brands specializing in unique protein sources, sustainable production methods, and regionally inspired flavor profiles.

Get this Report at $3500 | Get Your Discounted Report Now: https://www.futuremarketinsights.com/reports/sample/rep-gb-27082

Shop Market Research Reports Now: https://www.futuremarketinsights.com/checkout/27082

Outlook: Europe at the Forefront of Global Plant-Based Transformation

By 2035, the European vegan protein bars industry is expected to be valued at USD 980.8 million, reflecting its integral role in the continent’s broader shift toward plant-based living, ethical nutrition, and sustainability-led food innovation. As fitness culture strengthens and clean-label expectations rise, Europe stands poised to define the global future of vegan protein innovation—setting new benchmarks for quality, transparency, and responsible growth.

Browse Related Insights

Vegan Protein Bars Market: https://www.futuremarketinsights.com/reports/vegan-protein-bars-market

Vegan Cheese Market: https://www.futuremarketinsights.com/reports/vegan-cheese-market

Vegan Confectionery Market: https://www.futuremarketinsights.com/reports/vegan-confectionery-market

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.